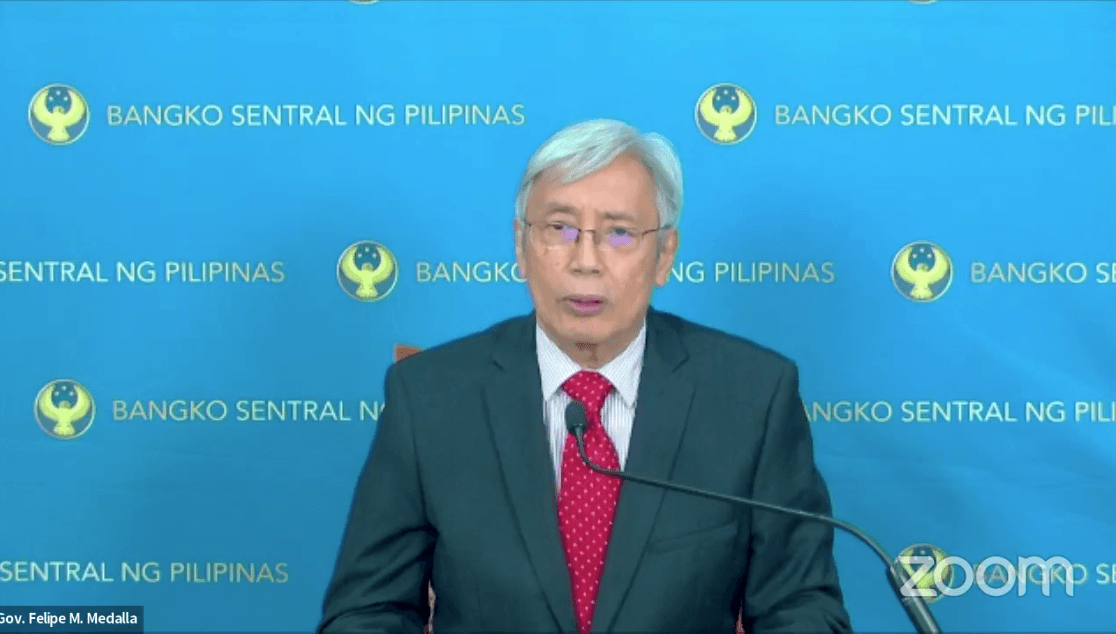

MONETARY POLICY. Bangko Sentral ng Pilipinas Governor Felipe Medalla holds a briefing on July 14, 2022.

BSP video screenshot

'Recent market developments have necessitated the adoption of a modified VASP licensing approach,' says BSP Governor Felipe Medalla

MANILA, Philippines – The Bangko Sentral ng Pilipinas (BSP) has imposed a three-year moratorium on granting licenses to new virtual asset service providers (VASPs).

The BSP said in a statement on Friday, August 12, that the Monetary Board approved the move “consistent with the thrust of the Bangko Sentral to maintain the integrity and stability of the financial system and strengthen consumer confidence in the digital ecosystem.”

“Recent market developments have necessitated the adoption of a modified VASP licensing approach,” said BSP Governor Felipe Medalla.

He explained that the modified approach “strategically shifts the focus to assessing the existing Bangko Sentral-registered VASPs’ overall performance and risk management systems, their impact on financial services and financial inclusion agenda, and their contribution towards the achievement of the Digital Payments Transformation Roadmap objectives.”

Under Resolution No. 1141, dated August 4, the regular application window for new VASP licenses shall be closed for three years starting September 1, 2022, subject to reassessment based on market developments.

Applications that have hurdled Stage 2 of the licensing process by August 31 would still be processed and assessed for completeness and sufficiency of documentation or information submitted, and compliance with the licensing criteria to operate as a VASP based on Stage 3 requirements.

Applications with incomplete requirements would be returned and deemed as closed.

Medalla said existing BSP-supervised financial institutions (BSFls) that are eyeing to expand operations through VASP services could still apply for a license provided that they have at least a stable Supervisory Assessment Framework (SAFr) composite rating.

“Under the modified approach, existing BSFIs with strong risk management systems including appropriate client suitability assessment and customer onboarding practices, and intensified financial consumer education and awareness programs may still apply for a VASP license,” Medalla said.

The central bank said it would continue to step up its surveillance of developments in the digital space, and intensify its consumer awareness campaign to alert the public on the risks of holding virtual assets.

“The Bangko Sentral remains supportive and proactive in responding to the developments in the digital financial ecosystem,” Medalla said.

BSP Deputy Governor Chuchi Fonacier said that “the BSP recognizes that as VAs offer opportunities to promote greater access to financial services at reduced costs, they also pose varied risks that may undermine financial stability.”

The BSP has granted licenses to 19 VASPs as of June. – Rappler.com